The topic of this post is:

Betting &- Information

–

–

#1. Don’-t trade on the VP predictions markets.

I have stong reservations about those VP prediction markets. Only 2 men in the world know what is going to happen: Barack Obama, and John McCain.

You can’-t divine their final thoughts.

Politicians often lie about their intentions —-they also change mind, frequently.

The decision to name one VP nominee could be made in secret —-without any early warnings.

Surprise is a card that Barack Obama and John McCain could play. Don’-t bet against their final will.

–

#2. Don’-t believe in “-vice presidential selection committees”-.

Last time, in 2000, a man named Dick Cheney was appointed to head George W. Bush’-s vice presidential selection committee.

He was supposed to scout around to find and assess good candidates.

Surprise, surprise, that fake committee ended up putting Dick Cheney on the Republican ticket —-and the rest is history (Iraq war, etc.).

–

#3. Don’-t bet on Hillary Clinton as VP.

She does not have the slightest chance.

It’-s highly unlikely that Barack Obama selects her on the Democratic ticket.

Hillary Clinton as VP nominee (and as VP) would present many quasi insurmountable problems.

–

#4. Don’-t listen to betting bloggers who tell you that Hillary Clinton has a chance to be on the Democratic ticket.

They are clueless.

Don’-t read clueless people. They are a waste of time.

–

#5. Select well your primary, advanced indicators.

- Go to the sources of information. Discard filters. Your insatiable curiosity should drive your search for information.

- Use technology to select the best news articles out there. Bookmark Memeorandum for US politics (and TechMeme for information technology) —-they use bloggers’- links to select what’-s hot, a bit like Google’-s PageRank does.

- Use the crowd to sense what’-s hot or to discover marginally interesting tidbits. I have 56 friends on Google Reader who share their best items with me. I got many interesting stories that way, every day, from sources I would have never known about, otherwise. (Plus, I receive many e-mails each day from potential sources.)

–

#6. Choose your bets (and trades) carefully.

Just because an event derivative is cheap doesn’-t mean that it’-s a good bet.

Don’-t pluck down money on a bet unless you’-ve seriously researched the topic by yourself —-and possesses some expertise or experience in that field.

–

–

FOLLOW-UP POST: 2 days after my ringing the alarm bell… THE FREE FALL

–

–

InTrade

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

BetFair

–

Next Vice President:

–

Democratic Ticket

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

NewsFutures

–

Barack Obama will pick a woman as running mate.

© NewsFutures

–

–

Explainer On Prediction Markets

–

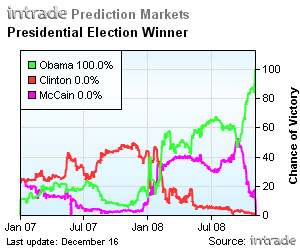

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

![]()

![]()