![]()

Wouarf.

He will lose his bet.

–

![]()

Wouarf.

He will lose his bet.

–

![]()

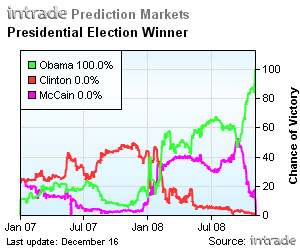

Yesterday at about 5:30PM EDT the Libertarian Party (U.S.) nominated ex-Congressperson Bob Barr for U.S. President. Barr’s nomination does not appear to have been certain — it took five rounds of voting, including two rounds where he tied for first and one in which in placed second.

So what do the relevant prediction markets make of this new information? Is Barr a contender, a potential spoiler, or irrelevant?

At Intrade, PRES.FIELD2008 has attracted no trades since May 22, three days before Barr’-s nomination. We didn’-t need a market to tell us a Libertarian Party nominee would not be a contender, nor help the chances of another non-Democrat and non-Republican.

The idea that Barr could be a spoiler is not completely ridiculous on its face (Barr and Wayne Allen Root, his running mate, are both recent ex-Republicans). However, PRES.DEM2008 has attracted no trades since May 24, the day before Barr’-s nomination, while PRES.REP2008 did not trade between 18 hours before the nomination and over 3 hours after.

I think we can conclude that traders believe Barr’s nomination will have no impact on the outcome of the election. And, sadly, that volume on Intrade is pathetic.

![]()

UPDATE:

– To be kept updated on the prediction markets, go to the frontpage of Midas Oracle, or click on the InTrade tag.

–

Here are the expired contracts about the Democratic vice presidential nominee (Joe Biden).

–

Here is the expired contract about the Repuiblican vice presidential nominee (Sarah Palin).

–

ORIGINAL POST:

–

Unlike Bo Cowgill, I have stong reservations about those VP prediction markets. Read this WSJ post, for more.

–

InTrade

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

BetFair

–

Next Vice President:

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

NewsFutures

–

Barack Obama will pick a woman as running mate.

© NewsFutures

–

–

Explainer On Prediction Markets

–

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

![]()

–

Oregon’-s Democratic Primary

–

InTrade

–

BetFair

–

Kentucky’-s Democratic Primary

–

InTrade

–

BetFair

–

NewsFutures

Some delegates from FL or MI will be seated at the Democratic Convention.

© NewsFutures

–

First look at individual states for the 2008 US presidential elections

–

2008 US Presidential Election Winner – Individual

–

2008 US Presidential Elections

Source: Dynamic, compound prediction market charts from InTrade

–

Next US President

–

Winning Party

–

Female President?

–

Democratic Candidate

–

Republican Candidate

–

Source: BetFair Politics Zone

–

Barack Obama to win the Democratic nomination

© NewsFutures

–

Hillary Clinton to win the Democratic nomination

© NewsFutures

–

Next US President Will Be Democratic.

© NewsFutures

–

Next US President Will Be Republican.

© NewsFutures

–

Explainer On Prediction Markets

–

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

More Info:

– The Best Resources On Prediction Markets = The Best External Web Links + The Best Midas Oracle Posts

– Prediction Market Science

– The Midas Oracle Explainers On Prediction Markets

– All The Midas Oracle Explainers On Prediction Markets

–

![]()

Don’-t you love the Web? Within 15 minutes after my posting my absolute and definitive refusal to publish any bits about the VP prediction markets, I received a long rebuttal by Google’-s Bo Cowgill —-whose great prediction market paper is still for you to download (PDF file), by the way.

Okay, Okay, Okay.

–

InTrade

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

BetFair

–

Next Vice President:

–

Democratic Vice President Nominee

–

Republican Vice President Nominee

–

NewsFutures

–

Barack Obama will pick a woman as running mate.

© NewsFutures

–

–

Explainer On Prediction Markets

–

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

![]()

Politico:

1. She lost the delegate derby.

2. She essentially tied Obama in the popular vote.

3. She lost more states.

4. She lost the January cash war.

5. The calendar is her enemy.

![]()

Michigan, U.S.A. —- Tuesday, January 15, 2008

—-

The Democrats

The Hillary Clinton event derivative was expired to 100.

—-

The Republicans

The Mitt Romney event derivative was expired to 100.

Source: InTrade

![]()

1. It really was an upset – As it has been pointed out elsewhere, the Clinton victory was a surprise to everyone. Favorites can lose. But so what? Ordinarily, that’s not a market flaw or a reason to doubt the odds shown in the market.

Justin Wolfers article in the WSJ had the best summary:

Against this background, it is no exaggeration to term the result truly historic. Not that there haven’-t been more dramatic upsets or come-from-behind wins that carried more significance —- this was just an early primary, albeit a pivotal one. But in terms of unpredictability, or at least the failure of everyone to predict it, it may have no modern match.

…

Historical comparisons are already being drawn between the New Hampshire primary and the famous 1948 presidential race…Yet the magnitude of the Clinton surprise is arguably even greater…-Thus, Sen. Clinton’-s victory on Tuesday was more surprising than President Truman’-s in 1948.

Given the above, were the Clinton prices on Intrade very far off? It’-s not obvious that they were.

2. Pundits/Critics are NOT traders – If I believe a contract should be trading around 30 and I see it trading at 7, it would make my day. As a trader, seeing a contract that is clearly mispriced is a good thing. Traders who remember the French politician Le Pen’s strong showing in 2002 vs his polls or who read Steve Sailer’s blog should not be surprised that people are dishonest with pollsters. However, to a pundit, an isolated incident of mispricing means the entire concept of prediction markets is faulty.

Since NH results, pundits have been asking, “Are prediction markets flawed?” The traders who make and move the market don’t believe so- they are trading more than ever. In any case, there were no postings on the 7th of January about how wrong the prediction markets are, only after-the-fact postings demonstrating perfect 20/20 hindsight. Traders, not critics, will determine the success of the prediction markets.

Let us not forget that pundits have an agenda too. For some, especially political ones, they need to present themselves as being able to offer insight that no one else has. Since prediction markets allow events to be quantified in real time, the pundits have less to add. This makes critics especially eager to take some of the shine off prediction markets and make themselves look smarter by comparison.

Additionally, there is a contingent of commentators and bloggers with an anti-market bias who delight in seeing any market based tool be wrong. They will be the first to loudly smear PM errors but no where to be found when the market turns out to be right.

3. PMs are not polls – This common mistake is exemplified by this quote from the Chicago Tribune, “The New Hampshire primary was a reminder that prediction markets, where bettors are putting money on the line, can have no more value than opinion polls, where participation costs nothing.” This critic missed the point and doesn’-t realize he is comparing apples and oranges.

Most commentators have focused on the accuracy of the market prices without touching on the underlying purpose of the market: speculation and hedging. Even if the polls are no more accurate than the market, they still can’t be used for trading functions.

4. Regulations have hurt the accuracy and liquidity of PMs – The inconvenience of opening a trading account at Intrade has excluded many Americans from participating. What is the cost of accuracy to the PMs? Surowiecki’s The Wisdom of Crowds lists four factors necessary for a wise crowd: diversity of opinion, independence, decentralization, and aggregation. At least two of these have been highly restricted due to regulations. Even so, the market is usually more accurate than the polls. None of the critics has pointed out that with so many potential traders cut off from trading, the market is surely excluding informed participants.

5. “Serious people who study or work with these markets are not in the ‘-markets are magic’- camp” – Prediction markets are like other financial markets: fat tails, black swans, bubbles, “manipulations” etc. These are all visible in housing, equities, and fixed income markets as well and no one speculates about the end of those instruments. As Eric Zitzewitz pointed out, the “markets are magic” crowd is just a strawman and not a logical basis to attack prediction markets.

Digg Link:

http://digg.com/business_finance/Top_Five_Reasons…-

![]()

…- I’-ll alert you to a developing story. [Slate’s Daniel Gross: Why were the political futures markets so wrong about Obama and Clinton?]

Thanks to a friend.

~alex

![]()

Justin Wolfers in the Wall Street Journal:

[…] Through this process of different people trading based on their own observations about the race, prediction markets prices come to aggregate disparate pieces of information into a single summary measure of the likelihood of various outcomes. Moreover, if this market operates efficiently, it will appropriately summarize all of this information and the price will become the most statistically accurate forecast of the election outcome. […]

If I may, I would like to jot down some thoughts related to my concept of prediction market journalism.

For all these reasons, I can give more than a straight B to Justin Wolfers’- copy. You can do better than that, prof. ![]()