![]()

TradeFair, soon.

Not a bad idea, but not the best idea they could have.

The EPS prediction markets were a better idea, because they have many more primary indicators.

–

![]()

TradeFair, soon.

Not a bad idea, but not the best idea they could have.

The EPS prediction markets were a better idea, because they have many more primary indicators.

–

![]()

Dear George,

Congrats for the launch of AskMarkets. Best wishes to your prediction exchange and consulting firm.

Here’-s the perfect opportunity to ask you the “-question that kills”-:

What was the social utility of the political election prediction markets during the 2008 campaign?

In other words, why should the media have informed people about the InTrade probabilities at a time Nate Silver did a near-perfect job forecasting the 2008 US elections?

What’-s the added value of the political election prediction markets over the poll aggregators?

Can you cite one prediction market (other than the “-who’-s gonna become president?”- prediction market) that has a high social utility?

Each time I ask this question to one of the prediction market luminaries (or so they think they are), I get back the same glance I would get from a dead trout —-so I would appreciate if you could attempt to answer my question by publishing a blog post on Midas Oracle.

Best regards,

Chris Masse, bombastic blogger

http://www.midasoracle.org/

![]()

Let’-s not confuse media visibility with utility. Aside from the depressed Obama-to-win prices on one exchange, prediction market and polling aggregation results for the 2008 election were essentially the same using squared errors. Despite his insane schematics, Emile Servan-Schreiber has a good point about capturing the interest of the public, something that nerdy academic and libertarian-types aren’-t necessarily good at. An Obama-backing baseball statistician out of Daily Kos nailed that part this year, a year where people were especially skeptical of markets, not to mention unregulated “-offshore”- ones. Likewise, if you put down the lens of considering markets as commission generators, you’-ll see the value of contracts tied to social and cultural outcomes. Of one the biggest assets of prediction exchanges is media goodwill, which should be fostered by distilling information on subjects like global development and art prices.

Other things to keep in mind:

![]()

Download this post to see the NewsFutures widget below.

![]()

I’-ve used the Bob Barr contracts at Intrade to poke fun at the totally unrealistic expectations of Libertarian Party advocates (a couple times at Midas Oracle), so here’-s a brief (and completely amateur) analysis of those contracts (and Nader contracts), post-election.

You may need to click on each chart to see the whole thing.

The probability of Barr obtaining 1% or more of the vote remained about .4 (40%) throughout the past several months. More optimistic scenarios became more discounted as the election grew nearer, and presumably it became clear Barr would not break through. Even 1% would have been seen as a breakthrough by LP advocates, but in the end Barr obtained only 0.4% of the vote. (Note that obtaining .4% of the vote and a .4 probability of obtaining 1% of the vote are very different things!)

Ralph Nader contracts attracted very little trading, though the 1% or greater contracts gave Nader a 60% chance of obtaining 1% of the vote as late as early October. Nader contracts for 3% and above did not trade at all —- or almost not at all —- Intrade’-s web page table (screenshot below chart) shows a few trades, but no advanced chart or closing price/volume download, and there seemed to be an (unrelated?) possible bug with Nader contract reporting fairly consistently —- last trade prices would not be remembered and reported in the aforementioned table —- or it could be user (me) error/misunderstanding.

Both Barr and Nader contracts were traded heavily (for them) post-election, presumably as traders freed up cash and unwound positions —- for unkown reasons Intrade still has not expired the contracts.

Spurred by comments from David Nolan (scan the page for “-Intrade”- or my name), I also attempted to gauge what traders thought about the average vote percentage candidates would receive across all scenarios —- even a small chance of a genuine breakthrough could make an otherwise hopeless campaign (in the LP’-s case, 9 such presidential campaigns prior to 2008) worthwhile. See below for the average (not most likely!) vote percentage over time each candidate might be expected to receive if the campaign were re-run may times. Assumptions: a floor of .5% (cases in which 1% is not met), very generous given that Barr did not reach even that, and only one LP candidate ever has, if candidate crosses threshold, they do so by .5%, also generous, and if 7% (the highest contract) is crossed, they obtain 7.5% of the vote, slightly ungenerous given the non-impossibility of obtaining a much higher percentage of the vote. Longshot bias should also expected to be at play. I don’-t think these numbers should give LP or other third party advocates any comfort, though I admit my own bias on the matter. The average of all Barr scenarios declined steadily as the election approached, while Nader contracts did not trade until closer to the election, and they both ended at an average of 1% across all scenarios just before the election.

In the end Nader received 0.54% of the vote, beating Barr for (a very distant) third place behind Obama and McCain.

All of the data used above may be found in intrade-2008-barr-nader.zip. The spreadsheet file intrade-2008-barr-nader.ods aggregates everything.

2012

I’-d like to see:

![]()

–

–

InTrade CEO John Delaney:

Our #1 untapped resource is the vast collective intellect that we have only started to use. Harnessing the “-wisdom of the crowd”- has a very big potential role in improving all of our lives. If we do it, we all have a voice and will feel part of the solution as well as the problem. We can solve some wicked problems, like climate, resource, growth, social, and economic challenges. In simple terms, there exists between us the best information on how we solve our key challenges. If our leader’s embrace and permission new systems like prediction markets to operate in a transparent prudent way I am convinced that we can contribute in no small part to the solution.

Recall, that US Department of Defence believed a prediction market could provide valuable information on growth, risks and social issues. Hundreds of academics, dozens of Fortune 500 companies, and millions of people believe that prediction markets can help provide valuable information on economic, financial, social and environmental issues.

–

I have already expressed my deep skepticism for this kind of grandiose discourse.

Today, if I may, I would like to ask these questions to John Delaney:

–

Here are my thoughts:

–

APPENDIX:

–

What Nate Silver predicted:

–

What InTrade predicted:

–

![]()

BetFair Predicts (a blog run by BetFair) titled “-The Power Of Objectivity”- a post giving the latest odds produced by BetFair on the race for the White House.

The real “-objectivity”- would have been to quote the odds produced by the other prediction exchanges, too —-InTrade, Iowa Electronic Markets, Betdaq, NewsFutures, HubDub, etc.

Midas Oracle is the only blog that lists prices and probabilities from all the prediction exchanges. No wonder, our daily readership is much, much bigger than the audience of all the other prediction market blogs combined. A blog that gives the odds of one exchange only is like a dead end —-no one trusts a dead end.

Please, do support Midas Oracle.

–

![]()

IT Business Edge – (I love the name of this magazine):

Seeking opinions from a diverse group of employees rather than just the usual decision-makers helps organizations mitigate risk, says Adam Siegel, co-founder and CEO of Inkling, Inc., a provider of prediction market software. “You want as much information as possible upfront so you can react to possible problems,” he says.

Siegel reads the 10K statements of potential clients to help identify their hot-button issues. When they express interest in the markets but wonder what kinds of questions to pose, he suggests establishing markets examining risk factors such as how pricing fluctuations affect the market for a company’s products or how acquisitions may impact the competitive landscape.

A drawback of prediction markets is that they won’t reveal the factors behind the bets. But, says Young, “If a red flag is raised about a particular issue, it’s not hard to go back and investigate” to determine the root causes of problems. “The bigger problem for most companies is they just don’t know what’s going to happen, and the red flag never goes up.”

–

– Excellent article.

– If you have missed our previous post, see here our little excerpt of the Forrester report.

– Adam Siegel is CEO of Inkling Markets, as you all know. His company website is very interesting to read. If you have never done it, do it right now. The general concept of prediction markets is explained, and they go down and dirty on how to set up your own enterprise prediction markets.

–

![]()

Below is a copy of a post yesterday on my personal blog. First, a couple asides for Midas Oracle readers.

After 2008

Two of Peter McCluskey’-s four sets of contracts produced interesting results while all of Polimetrics’- were duds. (Not complaining- I’-ll take the successes.) What should we take from this, other than a subsidy being helpful? (How helpful?)

It would be nice to see improved versions of the two successful sets offered for 2012 and perhaps for control of the US Congress in 2010. The Iraq contracts could be generalized to expected number of troops killed, number of troops abroad, or even size of the military budget.

It would be great to see conditional contracts for non-US jurisdictions as well.

On Intrade’-s part, I’-d really, really like to see implied outcomes and graphs of same built into the Intrade interface. Their lack is a huge barrier to understanding conditional contracts, both for journalists and bloggers who might come to appreciate their importance, and even for traders who need to understand them, even really smart traders.

Futarchy Lite?

Futarchy imagines that constituents or their representatives specify (presumably democratically) desired outcomes and prediction markets evaluate whether specific policies further desired outcomes, neatly captured in the phrase vote on values, bet on beliefs. One could imagine a variety of implementations, in particular concerning how policies are proposed, but that’-s the basic framework.

So what does the guide have to do with futarchy?

It encourages voters to govern their own vote as a policy making body would govern policies. Presumably individuals have values or can decide on them, so there’-s no voting, but one can use prediction markets to determine how they should vote in order to further their values. So the catchphrase for the futarchist voter guide below or what I’-ll call “-Futarchy Lite”- is vote with your values, consensus beliefs. Ok, that’-s not at all catchy. And I’-m afraid to too many people interpret values and beliefs to be roughly the same, but that’-s a bigger problem.

Mike’-s Futarchist Voter Guide (also posted on Mike’-s blog)

Four years ago I used play money contracts traded at the Foresight Exchange to provide a Futarchist Voter Guide (though I didn’-t call it that). This U.S. election cycle relevant real money contracts are traded on Intrade.

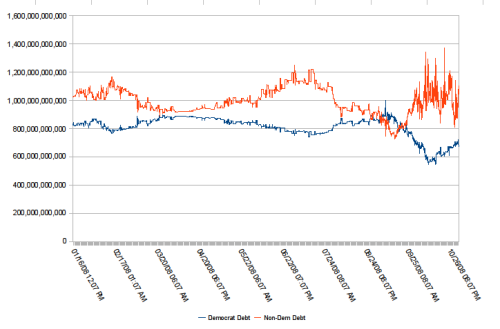

The first set was instigated and subsidized by Peter McCluskey. Two have attracted a fair amount of interest and seem to be informative. They have consistently indicated that a Democrat will result in a smaller (but still approaching US$1 trillion!) increase in the US federal government debt over one year and a smaller number of US troops in Iraq. (The others, regarding the movement of oil and interest rate futures on election day, have shown no difference between expected election outcomes.)

Above: Expected increase in US Government debt between 30 Sep 2010 and 30 Sep 2011 if party wins US presidency.

Above: Number of US troops in Iraq on 30 June 2010 if party wins US presidency.

Note that briefly in early September the contracts indicate lower debt and fewer troops in Iraq with a Republican candidate. I suspect this is due to McCain’-s brief surge following the GOP convention —- the implied outcomes above depend on election winner contracts, and with a much lower volume, presumably take awhile to fully respond to rapid shifts in election outcome expectations.

A second set of relevant contracts instigated by Polimetrics have unfortunately attracted almost no trading and probably tell us nothing. Note however they also reflect the brief McCain surge, at which point they implied a greater than 100% chance of growth, low unemployment, and lower crime with a McCain win. They have since reverted to showing essentially no difference between Obama and McCain. Note that each series only starts when there have been trades.

Above: Percent chance that economic growth averages 2.5% or more for 2009-2011 if individual wins US presidency.

Above: Percent chance the US unemployment rate is less than 5.0% at the end of 2011 if individual wins US presidency.

Above: Percent chance the number of violent crimes committed in 2010 is lower than the number of violent crimes committed in 2007 if individual wins US presidency.

Peter McCluskey has automatically updated pages showing implied outcomes for each set of contracts given their latest trades.

(I intended to make a page with frequently updating graphs, but got lazy when Peter published the aforementioned pages, and only collected the data until now, which is available in a spreadsheet.)