Why were the political prediction markets so wrong about Barak Obama and Hillary Clinton in New Hampshire?

…-asks Slate’-s Daniel Gross —-via Mister Usability (Alex Kirtland), who needs to go and get his own gravatar.

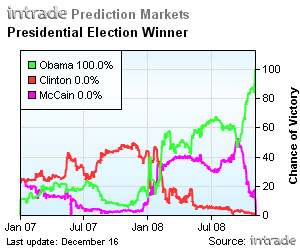

So, I’-ve been watching the action in one of the political futures markets this evening, Intrade. And the action in this prediction market has reinforced my opinion that these are less futures markets than immediate-past markets. The price movement tends to respond to conventional wisdom and polling data- it doesn’-t lead them.

Throughout the day and into the early evening, while polls were still open, Democratic investors, mimicking the post-Iowa c.w. and polls, believed Obama was highly likely to be the Democratic nominee. The Obama contract was trading in the lows 70s, meaning investors believed he had a 70 percent chance of being the nominee, while Hillary Clinton contracts were in the 20s. […] At 6 p.m., this market had written Hillary Clinton’-s entire presidential campaign off. At 9:30 p.m., it was calling a dead heat. What caused investors to change their minds so drastically in the space of a couple of hours? A few data points that went against the day’-s prevailing conventional wisdom and polls. […]

See also Niall O’-Connor’-s assessment:

I am looking forward to the post New Hampshire Caucus, when all you prediction market advocates crawl out from under your stones. For the record at one point the market on Intrade and Betfair was suggesting that Obama had a 95% probability of winning the caucas- whilst Intrade had him at 77% to win the nomination.A case perhaps of both the foolery of crowds and, the market biting back.

New Hampshire will go down as the Black Wednesday of prediction markets and unless there is now objective transparent debate (as opposed to the usual biased sabre rattling) – prediction markets will be dead in the water.

My answer to Dan Gross’- legitimate question and to Niall O’-Connor’-s snarky comment:

- Prediction markets are forecasting tools of convenience that feed on advanced indicators. When those advanced indicators are wrong, the prediction markets are wrong.

- If you prefer the polls or the pundits, your call —-but polls and pundits were also wrong, this time, right? Required reading for mister Niall O’-Connor: “-New Hampshire’-s Polling Fiasco”- + “-Analysis: pundits eat crow“-.

- The ultimate forecasting tool would be a way to reverse our psychological arrow of time —-so as to remember the future instead of the past. Only science-fiction writers and some imbecile (

) believe in that.

) believe in that. - The prediction market approach is to stick with the markets, on the long term. Take their successes. Take their failures. Unlike Donald Luskin and Markos Moulitsas, Chris Masse will not turn against the prediction markets when they fail punctually. What counts is the long series.

- My first point should be included in the prediction markets approach definition, in my view, but others (like economist Michael Giberson) might have different opinions.

- With respect to my first point, I bet that the prediction markets will never replace the polls as the forecasting tool of choice for political analysts —-on that particular point (but not on a myriad of others), I break away from Justin Wolfers’- irrational exuberance and I side with Emile Servan-Schreiber of NewsFutures (my preferred play-money prediction exchange). Prediction market reporting will have a function, indeed (as suggests Justin Wolfers), but not the dominant function.

- Going forward, prediction market journalism should emphasize relative accuracy (as opposed to absolute accuracy) —-that is, comparing prediction markets with polls and pundits, which is what Robin Hanson has said from day one. Our good friend Niall O’-Connor has difficulty to compute that, apparently. He should eat more fish.

—-

Justin Wolfers:

“In a few years, we may regard the second half of the 20th century as the aberration in which the press used polls rather than markets to track political races,” Justin Wolfers, a business professor at the University of Pennsylvania’s Wharton School, wrote in an e-mail message. “And in the 21st century, we may return to the habits of the early 20th century, reporting on political races through the lens of prediction markets rather than polls.”

Emile Servan-Scheiber:

1) The traders themselves are the first to look at the polls to inform their trades. So the polls are here to stay.

2) Our recent experience in Western Europe seems to indicate that the superior accuracy of markets over polls when predicting elections may be a U.S. artifact that isn’t so easily reproducible elsewhere. I’ve discussed this with Forrest Nelson of IEM [Iowa Electronic Markets], and apparently, ever since the Truman-Dewey polling debacle of 1948, U.S. pollsters have adopted a policy of reporting mostly raw numbers rather than projections based on sophisticated secret formulas, so they can’t be accused of manipulating opinion. However, raw numbers are notoriously unreliable when based on small samples, and Western European pollsters never report them, preferring instead to publish projections based on historically-informed statistical formulas. What we’ve observed in France and Holland is that it it’s very hard to beat the accuracy of such projections.

[I don’t make mine Emile Servan-Schreiber’s second point, but that’s a minor.]

—-

InTrade’-s expired prediction markets:

—-

New Hampshire

—-

The Democrats

—-

The Hillary Clinton event derivative was expired to 100.

—-

The Republicans

—-

The John McCain event derivative was expired to 100.

—-

Iowa

—-

The Democrats.

The Barack Obama event derivative was expired to 100.

—-

The Republicans

The Mike Huckabee event derivative was expired to 100.

—-

Source: InTrade

—-

[A more complete prediction market reporting should have included expired contracts from NewsFutures and BetFair. Sorry for that. Note that InTrade-TradeSports is the only exchange to offer a “closed contacts” section.]

—-

NEXT: Prediction Markets 101 + Who did best in explaining the prediction markets to the lynching crowd? + After the New Hampshire fiasco, 16 people came to defend the prediction markets, so far. + The prediction markets deserve a fair trial. + Prediction Markets = the greatest time-saving invention of this century

—-

![]() Ron Paul on CNN – YouTube video

Ron Paul on CNN – YouTube video

Author Profile -Editor and Publisher of Midas Oracle .ORG .NET .COM —- Chris Masse’-s mugshot —- Contact Chris Masse —- Chris Masse’-s LinkedIn profile —- Chris Masse’-s FaceBook profile —- Chris Masse’-s Google profile —- Sophia-Antipolis, France, E.U. Read more from this author…-

Author Profile -Editor and Publisher of Midas Oracle .ORG .NET .COM —- Chris Masse’-s mugshot —- Contact Chris Masse —- Chris Masse’-s LinkedIn profile —- Chris Masse’-s FaceBook profile —- Chris Masse’-s Google profile —- Sophia-Antipolis, France, E.U. Read more from this author…-