UPDATE: I just got it that Professor Leighton Vaughan-Williams’-s story and the BetFair compound chart published on top of his story should be understood independently from each other, as this chart was pasted there by the BetFair blog editor.

—-

Professor Leighton Vaughan-Williams on the official BetFair blog:

[…-] Those taking the same advice on Tuesday evening [2008-01-15 = date of the Michigan primary] were similarly well rewarded as well-backed Mitt Romney stormed into clear favouritism in the markets and a comfortable victory at the polls. After a blip in the New Hampshire Democratic primary the old certainties – that election favourites tend to win elections – was re-established.

As in the Republican New Hampshire primary, the polls and pundits had declared the race between Senator McCain and Governor Romney as a toss-up while the betting markets pointed to a comfortable victory in both cases for the eventual winners. Once again, in the battle of the polls, pundits and markets, the power of the betting markets to assimilate the collective knowledge and wisdom of the crowd had prevailed. […-]

No BetFair charts are provided. Bad prediction market journalism.

UPDATE: The compound chart was under my very nose:

—-

UPDATE: I just got it that Professor Leighton Vaughan-Williams’-s story and the BetFair compound chart published on top of his story should be understood independently from each other, as this chart was pasted there by the BetFair blog editor.

—-

UPDATE: The BetFair blog has added a new label on the infamous compound chart…-

—-

NEXT: Did the BetFair blog use trading data from InTrade to hint at BetFair’-s accuracy??

—-

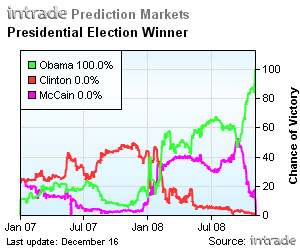

For your information, I re-publish below the InTrade charts of the last 3 primary races (Wyoming excluded). [BetFair and NewsFutures do not provide on their site the charts of expired contracts. I could ask them later, though.]

—-

Iowa

—-

The Democrats.

The Barack Obama event derivative was expired to 100.

—-

The Republicans

The Mike Huckabee event derivative was expired to 100.

—-

New Hampshire

—-

The Democrats

—-

The Hillary Clinton event derivative was expired to 100.

—-

The Republicans

—-

The John McCain event derivative was expired to 100.

—-

Michigan

—-

The Democrats

The Hillary Clinton event derivative was expired to 100.

—-

The Republicans

The Mitt Romney event derivative was expired to 100.

Source: InTrade

Author Profile -Editor and Publisher of Midas Oracle .ORG .NET .COM —- Chris Masse’-s mugshot —- Contact Chris Masse —- Chris Masse’-s LinkedIn profile —- Chris Masse’-s FaceBook profile —- Chris Masse’-s Google profile —- Sophia-Antipolis, France, E.U. Read more from this author…-

Author Profile -Editor and Publisher of Midas Oracle .ORG .NET .COM —- Chris Masse’-s mugshot —- Contact Chris Masse —- Chris Masse’-s LinkedIn profile —- Chris Masse’-s FaceBook profile —- Chris Masse’-s Google profile —- Sophia-Antipolis, France, E.U. Read more from this author…-

Read the previous blog posts by Chris. F. Masse:- Are David Pennock’s search engine prediction markets the worst marketing disaster since the New Coke?

- Midas Oracle is incontestably [*] the best vertical portal to prediction markets.

- Comment spam paid by Emile Servan-Schreiber of NewsFutures-Bet2Give

- BetFair Games needs a Swedish provider to develop its gambling offerings.

- When Markets Beat the Polls – Scientific American Magazine

- Robin Hanson has some fanboy in India. Great. Tiny caveat: The parroting Indian writer does not acknowledge Robin Hanson by name.

- Molecular Nanotechnology

![]()

InTrade embraces ‘-crowd sourcing’-:

InTrade embraces ‘-crowd sourcing’-: