![]()

A commenter on his blog (Bill):

Why not experiment at GMU?

Have the students run the university using Futarchy principals. They pick the goals, then you use markets.

You can even start on a smaller scale, a class.

Report back on your experiment.

![]()

A commenter on his blog (Bill):

Why not experiment at GMU?

Have the students run the university using Futarchy principals. They pick the goals, then you use markets.

You can even start on a smaller scale, a class.

Report back on your experiment.

![]()

Robin Hanson debates a Mencius Moldbug on prediction markets, decision markets, and…- futarchy:

Foresight 2010 debate: Futarchy from Monica Anderson on Vimeo.

Download this post to watch the video —-if your feed reader does not show it to you.

![]()

– Robin Hanson comments on Paul Hewitt’-s blog.

– Paul Hewitt comments on Eric Crampton’-s blog.

– Paul Hewitt comments on Robin Hanson’-s blog. Many exchanges with Robin Hanson. Read it all.

– Paul Hewitt:

[…] My point is that the case for prediction markets has not been made, at all. There is a tiny bit of proof that they are as good as alternative methods, and in a very few cases, very slightly better. Also, you need to be aware that even the slightly better prediction markets had the benefit of the alternative forecasting institution available to it. That is, the official forecasters at HP were also participants in the ever-so-slightly better prediction markets. […]

–->- I personally stay away from any discussion about conditional prediction markets (and futarchy). I prefer focusing on the ’-simple’- prediction markets.

![]()

Paul Hewitt: The Essential Prerequisite for Adopting Prediction Markets

It is a long text, so I will post again about it, in the near future. (Happy Xmas, by the way.)

ADDENDUM: Saturday, January 16, 2010: Debate between Robin Hanson and Mencius Moldbug

![]()

Saturday, January 16, 2010

Debate between Robin Hanson and blogger Mencius Moldbug about futarchy, “-a subject on which fur has flown over the blogosphere.”-

![]()

![]()

Below is a copy of a post yesterday on my personal blog. First, a couple asides for Midas Oracle readers.

After 2008

Two of Peter McCluskey’-s four sets of contracts produced interesting results while all of Polimetrics’- were duds. (Not complaining- I’-ll take the successes.) What should we take from this, other than a subsidy being helpful? (How helpful?)

It would be nice to see improved versions of the two successful sets offered for 2012 and perhaps for control of the US Congress in 2010. The Iraq contracts could be generalized to expected number of troops killed, number of troops abroad, or even size of the military budget.

It would be great to see conditional contracts for non-US jurisdictions as well.

On Intrade’-s part, I’-d really, really like to see implied outcomes and graphs of same built into the Intrade interface. Their lack is a huge barrier to understanding conditional contracts, both for journalists and bloggers who might come to appreciate their importance, and even for traders who need to understand them, even really smart traders.

Futarchy Lite?

Futarchy imagines that constituents or their representatives specify (presumably democratically) desired outcomes and prediction markets evaluate whether specific policies further desired outcomes, neatly captured in the phrase vote on values, bet on beliefs. One could imagine a variety of implementations, in particular concerning how policies are proposed, but that’-s the basic framework.

So what does the guide have to do with futarchy?

It encourages voters to govern their own vote as a policy making body would govern policies. Presumably individuals have values or can decide on them, so there’-s no voting, but one can use prediction markets to determine how they should vote in order to further their values. So the catchphrase for the futarchist voter guide below or what I’-ll call “-Futarchy Lite”- is vote with your values, consensus beliefs. Ok, that’-s not at all catchy. And I’-m afraid to too many people interpret values and beliefs to be roughly the same, but that’-s a bigger problem.

Mike’-s Futarchist Voter Guide (also posted on Mike’-s blog)

Four years ago I used play money contracts traded at the Foresight Exchange to provide a Futarchist Voter Guide (though I didn’-t call it that). This U.S. election cycle relevant real money contracts are traded on Intrade.

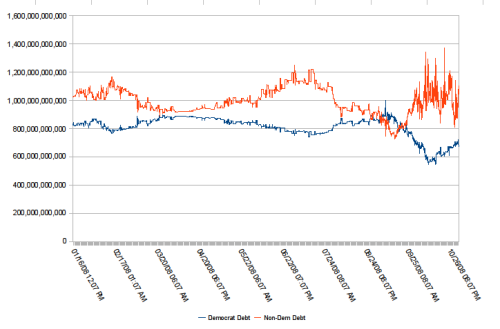

The first set was instigated and subsidized by Peter McCluskey. Two have attracted a fair amount of interest and seem to be informative. They have consistently indicated that a Democrat will result in a smaller (but still approaching US$1 trillion!) increase in the US federal government debt over one year and a smaller number of US troops in Iraq. (The others, regarding the movement of oil and interest rate futures on election day, have shown no difference between expected election outcomes.)

Above: Expected increase in US Government debt between 30 Sep 2010 and 30 Sep 2011 if party wins US presidency.

Above: Number of US troops in Iraq on 30 June 2010 if party wins US presidency.

Note that briefly in early September the contracts indicate lower debt and fewer troops in Iraq with a Republican candidate. I suspect this is due to McCain’-s brief surge following the GOP convention —- the implied outcomes above depend on election winner contracts, and with a much lower volume, presumably take awhile to fully respond to rapid shifts in election outcome expectations.

A second set of relevant contracts instigated by Polimetrics have unfortunately attracted almost no trading and probably tell us nothing. Note however they also reflect the brief McCain surge, at which point they implied a greater than 100% chance of growth, low unemployment, and lower crime with a McCain win. They have since reverted to showing essentially no difference between Obama and McCain. Note that each series only starts when there have been trades.

Above: Percent chance that economic growth averages 2.5% or more for 2009-2011 if individual wins US presidency.

Above: Percent chance the US unemployment rate is less than 5.0% at the end of 2011 if individual wins US presidency.

Above: Percent chance the number of violent crimes committed in 2010 is lower than the number of violent crimes committed in 2007 if individual wins US presidency.

Peter McCluskey has automatically updated pages showing implied outcomes for each set of contracts given their latest trades.

(I intended to make a page with frequently updating graphs, but got lazy when Peter published the aforementioned pages, and only collected the data until now, which is available in a spreadsheet.)

![]() Robin Hanson:

Robin Hanson:

[…-] The main problem with using [Michael] Abramowicz’-s book as a “-technical manual”-, however, is that he’-s never actually seen, much less touched, most of the blocks he describes. His conclusions are not supported or tested by math models, computer simulations, lab experiments, field trials, nor a track record of successful past proposals – it is all based on his untested intuitions. And he doesn’-t seem inclined to do any such testing himself – he hopes his book will inspire others to do that. There is of course a spectrum of rigor in how solidly one can support a claim. Most business decisions are based on far less rigor that elite academics often demand, and there is surely a place for “-brainstorming”- speculation. Compared with most academics, I admit I have often been more than toward the speculation end of the spectrum, though I have tried to test my speculations via math models, lab experiments, field trials, and have arguably collected a modest track record of success. […-]

Michael Abramowicz’-s response:

[…-] The incentives provided by two of my technical proposals (the decentralized subsidy approach and the nobody-loses prediction market) are sufficiently straightforward to me that math seems superfluous to me, though I agree that field tests comparing these with alternatives would be useful. Two of the proposals (the text-authoring market and the market web) could certainly benefit from experimentation, but the software needed to implement them would be considerably more complicated than what is needed for existing prediction markets. […-]

Robin Hanson’-s second take.

Michael Abramowicz’-s post.

Robin Hanson on futarchy vs. predictocracy.

Michael Abramowicz.

Robin Hanson.

I will blog about this book, once I have read it, in the near future.

Predictocracy = Market Mechanisms for Public and Private Decision Making

All the book is online, at the web address above. You can also buy it at bookshops, or at Amazon.

Read the previous blog posts by Chris F. Masse: