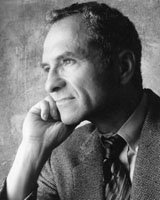

Sean Park (Founding Partner at Sixth Paradigm, and blogger at The Park Paradigm)

Sean Park is a leading independent thinker on the future of financial markets, the author of The Park Paradigm, and the founding partner of Sixth Paradigm LLP:

The technology of the digital age is driving an unprecedented explosion in the ability to create markets in anything. Trade anything. Not just physical goods. Not just financial instruments. But ideas. Events. Outcomes. The emergence of these kinds of markets will – over time – impact how we view and interact with the world in all aspects of our personal and professional lives. They will fundamentally alter the current world economic and social paradigm.

Sean is also a founding investor in innovative companies such as Betfair and WeatherBill (where he is also a non-executive Director) and has extensive experience investing in and advising start-up and high growth companies in addition to over 16 years of experience working at a senior level in capital markets and investment banking. Building businesses has been a key theme throughout his career.

I’-m bullish on WeatherBill. They showed that an event derivative exchange can have a more user-friendly interface —-stuff that BetFair-TradeFair and TradeSports-InTrade have not computed yet. I wonder whether the WeatherBill approach could work out with other risks —-other than weather.

On Sean Park, as a blogger, one of my sources said to me that he sometimes elaborates on ideas invented by others years ago and makes it like they are his. I’-m a brand-new feed subscriber to his little blog, so I’-ll judge by myself.

—-

Previously: Thoughts on Weather Bill – by Eric Zitzewitz – 2007-01-04

What I think is most innovative is the idea of marketing a prediction market contract as “insurance.”

![]() Phil Gordon on Poker

Phil Gordon on Poker